Introduction

Fluctuations in export concentration indices are closely linked to the vulnerability of a given country to external shocks. Therefore, the main purpose of the article is to calculate the normalized Herfindahl-Hirschman indices (Product[i] or Market Concentration[ii]) to identify how vulnerable the economy of Armenia became to the shock after the Russian-Ukrainian war and its impact in the medium term. Although higher values of concentration indices imply higher vulnerability, a drastic decrease in index values will be reported in 2025 and the medium term, and they would return close to the pre-war values, with Armenia still being dependent on the developments in key markets and commodity price volatility.

Armenia’s rising export concentration indices

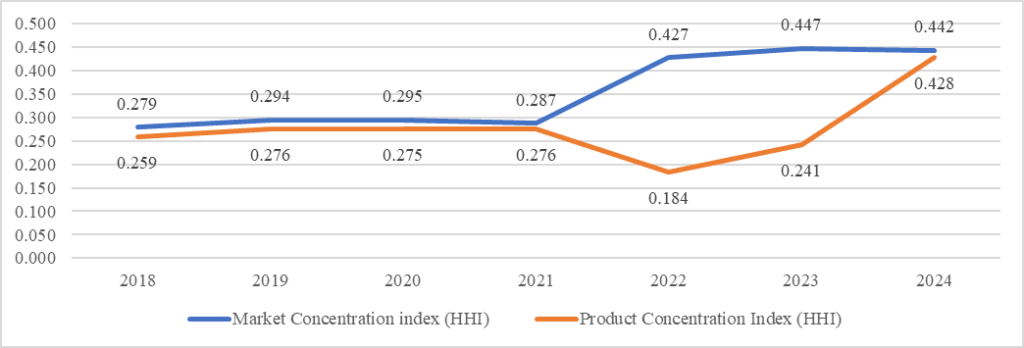

Armenia’s export market and product concentration indices reported notable fluctuations in 2018-2024 (see Figure 1), along with a tremendous increase in merchandise exports from 2022 to 2024. In 2021, both indices were higher than in 2018. This increase was substantiated by the rising concentration in fewer markets and the dominance of a few products (namely product lines at the HS 4-digit level, such as copper ores and concentrates, etc.) in the composition of Armenian merchandise exports.

Figure 1. Armenia’s export Concentration Indices from 2018 to 2024[iii]

Source: Statistical Committee of Armenia.

Note: Authors’ calculations

The Russian-Ukrainian war seriously affected the values of indices in the period 2022-2024, reflecting the major shifts observed in the composition of the merchandise exports and the rise of the United Arab Emirates as the major export destination by replacing Russia in 2024. The shifts reported are the follows:

Figure 2. Exports to main destinations (%, merchandise trade of Armenia) from 2018 to 2024[iv]

Source: Statistical Committee of Armenia.

Note: Authors’ calculations

Shifts in the merchandise export composition and list of the top destinations to expect and the impact on the economy

In the period 2025-2026, Russia could regain its position as the top export destination, with the UAE and Hong Kong disappearing from the list of top 5 export destinations, thus causing a serious decline in the value of the Market Concentration Index and a return to the pre-war market values. Exports of gold and diamonds (HS Chapter 71) would no longer dominate as the top Chapter; on the contrary, the exports of companies representing the mining of metal ores industry (including exports of ferromolybdenum) would regain their share in the composition of merchandise exports. However, the values of both indices could be higher than in previous years before the Russian-Ukrainian war, indicating the need for broader market and product diversification and making the economy more resilient. The expected drop in the values of both indices would not affect many companies and employees. On the contrary, layoffs and a hike in the unemployment rate could be expected if the Russian economy is seriously hit by oil price volatility, resulting in a financial crisis (namely, currency crisis). Overall, the exports-to-GDP ratio could significantly decline and approach pre-war values (in 2021: 35.9%; in 2024: 76.3%). The GDP growth rate would slow as well.

The shifts in the merchandise exports would be mainly associated with the traditional exports in the medium term. Exports of the companies representing the mining of metal ores industry (including exports of ferromolybdenum) will comprise the largest share of exports, along with the exports of traditional products such as tobacco products, alcoholic beverages, wearing apparel, agriculture, and processed food products, and emerging exports of gold of Armenian origin from Amulsar. Commodity price volatility on the global market could affect exports and foreign exchange earnings. However, it would not cause statistically significant changes in the GDP[v]. The macroeconomic stance in Russia would affect the export of products of Armenian origin concerning agricultural, processed food items, and alcoholic beverages.

If Armenian companies adhere to the rigorous standards of Western markets (mainly the EU), it could make the Armenian economy more resilient to developments in the Russian market, thus achieving a higher degree of diversification.

Conclusion

Fluctuations in the Export Product and Markets concentration indices, specifically in 2022-2024, could warn about serious vulnerability to external shocks in the medium term. However, the values of these indices would come close to the pre-war values. Overall, commodity price volatility and the macroeconomic situation in Russia could affect the exports of traditional products of Armenian origin unless Armenian companies manage to comply with the standards and channel these products to EU markets in the medium term.

Abstract

The calculated normalized Herfindahl-Hirschman indices highlighted the economy’s greater vulnerability to external shocks from 2022 to 2024. The values of the Indices would come close to the pre-Russian-Ukrainian war values. In the medium term, commodity price volatility and Russia’s macroeconomic stance could affect merchandise exports, urging Armenia to build close ties with the EU.

Authors

Anna Makaryan, Ph.D. in Economics, Nexus Intellect Research NGO & M. Kotanyan Institute of Economics of the National Academy of Sciences of Armenia, https://orcid.org/0000-0003-0505-7869

Hamlet Mkrtchyan, Ph.D. in Economics, Nexus Intellect Research NGO & Armenian State University of Economics, https://orcid.org/0009-0002-8588-2921

Verej Isanians, Ph.D. in Public Policy, Nexus Intellect Research NGO, https://orcid.org/0009-0008-1145-9251

[i] United Nations Conference on Trade and Development. (2019). Export product concentration index: Indicators explained #3 (UNCTAD/STAT/IE/2019/1). UNCTAD. Retrieved from: https://unctadstat.unctad.org/EN/IndicatorsExplained/statie2019d1_en.pdf, (Date of access: April 29, 2025).

[ii] United Nations Conference on Trade and Development. (2018). Export market concentration index: Indicators explained #1 (UNCTAD/STAT/IE/2018/1). UNCTAD. Retrieved from: https://unctadstat.unctad.org/EN/IndicatorsExplained/statie2018d1_en.pdf, (Date of access: April 29, 2025).

[iii] Statistical Committee of Armenia.

[iv] Statistical Committee of Armenia.

[v] Galoyan, D., Tadevosyan, Z., Makaryan, A., & Mkrtchyan, H. (2024). Mining of Metal Ores Industry and Economic Growth Nexus in Armenia: Challenges and Prospects. Proceedings on Engineering Sciences, 6(2), 731–744. Doi: 10.24874/pes06.02.030.